Back to Blogs

Back to Blogs

Hospitality Demand Generation Trends & Opportunity Costs

Summary of article published in Hospitality Upgrade - Fall 2015:

Much is made of love-hate between hotels and online travel agencies, but what really are the opportunity costs around putting “heads in beds”? The only way to understand the whole picture is to compare all-in opportunity costs for various demand sources and this goes well beyond OTAs to include marketing, PPC and affiliation/loyalty costs.

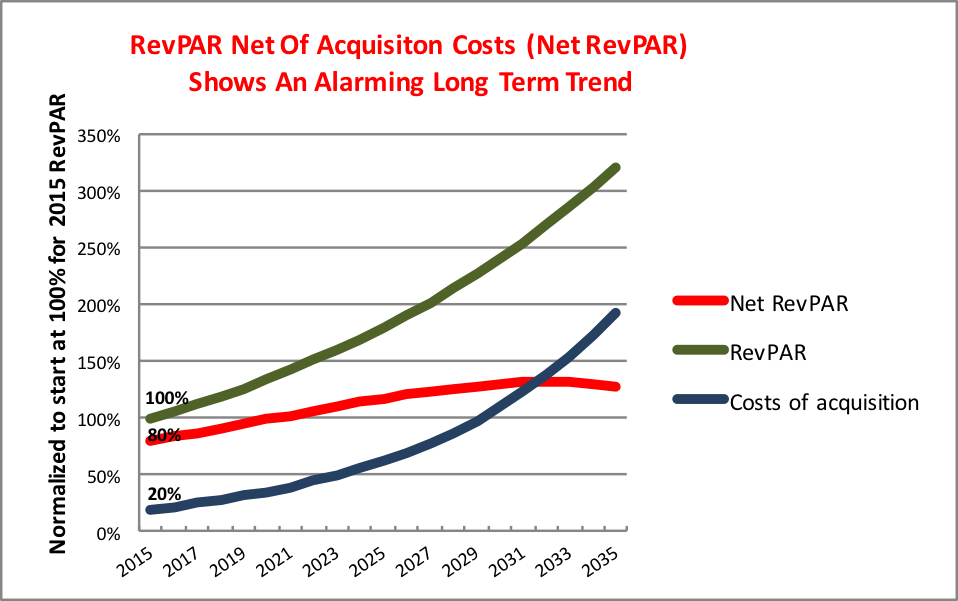

Hospitality has been on a roll since it recovered from the 2009 downturn, but while average daily rates and occupancy rates are on a rising trend, faster rising demand generation costs are hurting profit growth.

With costs of acquisition growing twice as fast as Revenue Per Available Room (as Cindy Estis Green of Kalibri Labs has documented), the rising RevPARs give a false sense that all is well and getting better.

At the same time, guest behavior changes plus competition from OTAs, meta search engines (think Kayak), hybrids (think TripAdvisor), and alternative lodging providers (think Airbnb and HomeAway) plus Google’s evolution have changed the landscape.

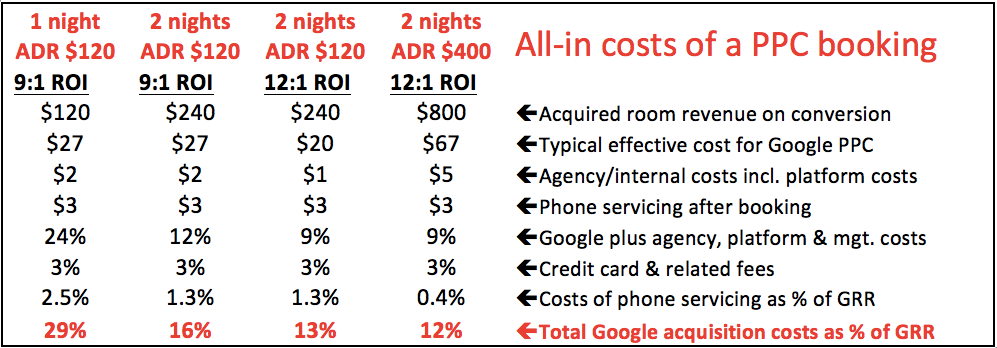

The worrisome picture is true overall for acquisition costs but increasingly so for PPC and mobile advertising costs. The old hotelier mindset of thinking of OTAs as enemies and Google as a friend is being replaced by a healthy recognition that we’re all “frenemies”. Unsurprisingly, as hotel PPC bid costs rise, the PPC ROIs that at first looked very enticing may need a serious second look:

Essentially, looking at “all-in costs” demand generation via Google PPC is not too different from retail commissions or net rate discounts, and managing these high and fast increasing costs effectively often makes the entire difference between rising or declining profits. In some cases, for example for a single night stay, effective Google PPC all-in costs may actually be quite a bit higher than a typical retail commission.

For that matter, direct bookings aren't free either. What appears to be “free” as a booking via a hotel’s Web site and central reservations system in fact comes attached to a variety of costs:

- Technical, transaction and servicing costs

- Brand / repco fees including the costs attached to loyalty-driven bookings

- Negotiated rate discounts

In this new world, every day and in every way, smart hoteliers are making choices:

- Affiliation vs. Independence

- Google vs. Channels vs. Metas

- Negotiated rates vs. Consortia discounts vs. Loyalty program costs

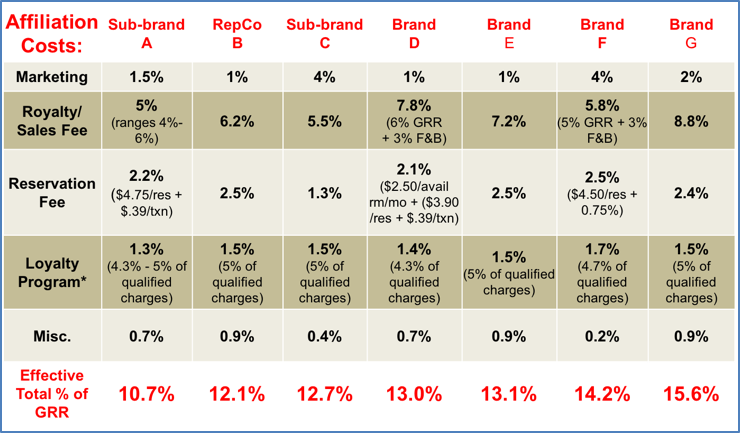

Affiliation with a major brand is often thought of as a great thing - you flag or re-flag and presto: built-in demand. However, it costs a pretty penny too.

(expressed as effective % of Gross Room Revenue unless indicated otherwise)

*Qualified charges = GRR + F&B for Loyalty members (assume 20% of reservations)

One good bit of news hotels is that as brands and repcos compete for growth, there's downward pressure on affiliation costs. As reported in the Financial Times on August 31st, 2015 (Starwood targets UK and Europe for growth with Tribute chain) Starwood is proposing that “independent hotel owners pay between 4 per cent to 6 per cent of their room revenues to Starwood in return for access to the group’s booking system, marketing and its Starwood Preferred Guest loyalty scheme”.

This news report is very surprising as normal fees (see Affiliations Costs chart) are two to three times higher. It may be that the Financial Times got it wrong, but if true, Starwood is offering Tribute hotels the benefits of affiliation for half of typical charges that say Marriott would charge and Autograph hotel.

Along another positive front, Google has recently recognized that (as shown above) its old CPC model was increasingly problematic for independent hotels and even for brands. Accordingly, it has shut down Hotel Finder and announced a global program based on the retail commission model. The Google Hotel Ads Commission Program is available globally and, together with Google’s Instant Booking (for now U.S. based), it allows hotels to pay a modest commission on actually delivered bookings without having to gamble on PPC costs that were getting out of hand.

Taken together, these developments suggest that although distribution costs are rising too fast, there is downward pressure on both brand affiliation costs and Google-based distribution costs, which owners and operators will surely welcome.

Previous Post

Previous Post